Beyond ‘first-aid’ and emergency treatments!

The ‘black swan’ has happened. Its impact will be deeply felt, from supply chains to demand chains, from wall streets to main streets, from unicorns to incubators. One thing is for sure i.e. it will not be business as usual. 2020 plans and longer term business plans (based on a very different set of assumptions), will need to be ‘ground zeroed’. Broadly, there will be two possibilities in the way forward:

- The recovery (back to what we call ‘normalcy’) will take significant time, therefore businesses will need to re-configure its entire eco-system – its Sights, Strategy, Structure, Staff & Systems.

- Consumption and Production will remain sluggish, markets will sink to a new low and will need to operate at that level. This will also need businesses to re-configure its entire eco-system.

Either way, it’s time to go back to the drawing board and start the re-configuration process – with an entirely new mind-set. Welcome to the New Normal!

The bad news is that there is no quick fix ‘pain killer’, particular for businesses that have recklessly expanded and put on ‘fat’ in good times. The good news is that if you take strong fundamental measures now, you may be able to get your business gradually back on track and more importantly ensure it is able to withstand future crisis that can impact businesses.

Crisis that impact business – has and will continue to happen, more frequently!

Since the tulip crisis in 1637 (earliest documented), economies and business have been impacted such crisis. In more recent history, the world had experienced the Great Depression (1929), Asian Financial Crisis (1997), the Dot-com Bubble (2000), the Global Financial Crisis (2008).Through all these crisis, we have witnessed the failure of some of the strongest companies that enjoyed meteoric rise in the good times.

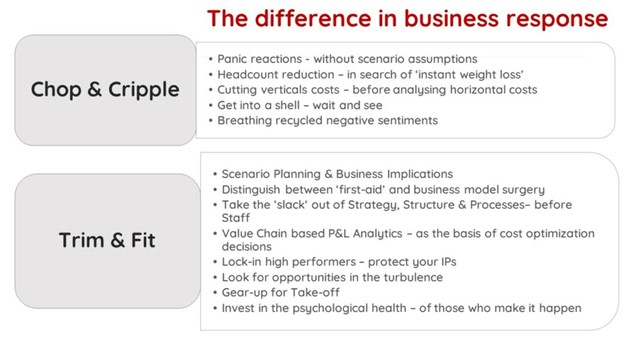

It’s not the crisis that will cripple your business, it’s your business response to the crisis

Extensive Research and MTI’s own international experience (across 47 countries in the 23 years) shows that how businesses respond to the crisis, is what separates those that ‘survive and thrive’ from the ‘departed’. work and adopt a ‘wait & see’ approach. We call them the ‘Chop & Cripple’ companies.

By contrast, the Smarter Companies (we call them ‘Trim & Fit’ companies), while being prudently cautious, uses the crisis period as an opportunity to critically evaluate every aspect of its Strategy, Structure, Staff and Systems, challenging every dollar and every stroke of work as to the value added. They also see the upside of acquiring low valued assets, strengthening their market position (given lower level of competitive / marketing activity) and gearing their organizations for the upturn.

The Chop & Cripple Approach

Panic reactions – without scenario assumptions

A ‘storm’ would only last for a relatively short period of time – in the context of a business’ lifespan. If these conditions are to remain for foreseeable future, then it is the normal operating environment and not a ‘storm’. These businesses tend to take a very short term, myopic outlook – assuming it has been doomed forever. Therefore most of the decisions they take tends be very myopic and likely to be damaging to the business in the post-crisis period.

Headcount reduction – in search of ‘instant weight loss’

The ‘Chop & Cripple’ companies tend to see Headcount as the first, the most lucrative (in a very narrow sense) and in most cases the only way to ‘chop’ costs, that is likely to cripple them post the crisis. Such ‘chops’ however compelling it appears to be (in a moment of crisis), tends have far reaching negative implications on the organization, its functioning and employee engagement.

Cutting verticals costs – before analysing horizontal costs

Vertical Costs are ones characterized by the type of cost item e.g. salaries, training, travel, promotion etc. Horizontal Costs are costs which have been re-casted along the value chain of the business, from inputs to outputs of the business model e.g. product development, supply chain, production, go-to-market etc. The ‘Chop & Cripple’ companies tend to initially and only focus on the Vertical Costs, where their response is to indiscriminately ‘chop’ them, thus crippling their operations.

Get into a shell – wait and see

The ‘Chop & Cripple’ companies tends put the shutter up across most of their development activities and tend to take a ‘wait and see’ approach. This myopic approach undoes a lot development work that was in progress, with significant level of staff capacity (during the crisis period) wasted. This could also lead to a culture of lethargy and make it that more challenging for such companies to be ready for the take-off post the crisis.

Breathing recycled negative sentiments

We are what we think and our thinking is what determines our actions, particularly in such trying times. The ‘Chop & Cripple’ companies tend to spend a significant level of their energies on talking negativity, actively seeking negative news (including gossip and fake news), blaming the environment and getting into a self-pity mode. It creates such a toxic environment that such companies have very little energy left to focus on the turnaround process, except panic reactions.

“When confronted with a Crisis, there is a choice to make. Be a Cry-sis or be a Try-sis”

The Trim & Fit Approach

Scenario Planning & Business Implications

Except for the ‘first-aid’ decisions that a business would make in response to the crisis, all its other decisions will depend on the operating environment it expects in a defined future period. Therefore, define possible scenario possibilities – based on a combination of historical performance extrapolation, future dynamics and appropriate cross-situational learnings.

Then for each of these scenarios, determine potential business implications and counter responses. Based on management judgement, the business may be forced to pick one scenario and develop its strategies and plans based on this. Yes, there will be an element of risk, especially if the assumption is a drastic change in the expected operating environment – compared to the pre-crisis one. Of course, there is also a risk of not making any assumptions and just floating along.

“The Corona-virus has wiped off billions of dollars from global stock markets. Where has all this money disappeared to? Or have we just discounted our imaginary future valuations?”

Distinguish between ‘first-aid’ and business model surgery

When confronted with an unexpected ‘storm, the business will need to respond. The immediate response will be to address the challenges that need ‘first-aid’ treatment, but recognizing that ‘first-aid’ is only a temporary pain relief and that most ‘storms’ will require major changes to its business model. The ‘Trim & Fit’ companies are able to clearly distinguish between the two types of responses and know when and how to integrate them into action.

Take the ‘slack’ out of Strategy, Structure & Processes– before Staff

The number of staff a business needs is a function of its strategy – based on which it determines the organizational structure and the processes (i.e. activities it needs to perform).The ‘Trim & Fit’ companies would first take the ‘slack’ out of their strategy (e.g. rationalizing products, brands, customers, channels, supply chain, demand-generating activities etc.).

Once this is done, the ‘slack’ in its structure and processes (activities) becomes clearer and can then be rationalized. This would ultimately, point out the ‘slack’ in the head count, specifically indicating in which parts of the structure and to what depth.

“Corona has reduced carbon emissions, but that’s choking the global economy!”

Value Chain based P&L Analytics – as the basis of cost optimization decisions

Whilst the first response of ‘Chop & Cripple’ companies to cut vertical costs (such as head count, training, business development, R&D etc.), the ‘Trim & Fit’ would first resort to converting their conventional P&L to a Value Chain based P&L.

This converts and places all existing costs (at a relevant granular level) into specific value chain functions, thus helping to challenge each such cost item for the value-added.Once these Horizontal (value chain) costs are addressed, then move on the Vertical Costs.

Lock-in high performers – protect your IPs

Because companies tend to take a ‘blanket’ approach to cost cutting and operational scale-backs, there is a tendency for your high performing staff to be de-motivated and get poached by farsighted competitors. The same is likely to happen with your most profitable customers, channel partners and supply chain.

The ‘Trim & Fit’ companies, backed by performance analytics, tend to discriminate based on contribution, whilst being fair and considerate with stakeholders who may be adversely impacted by such preferential treatment.

Look for opportunities in the turbulence

In the midst of all the turbulence, there will be very attractive opportunities to ‘acquire’ businesses, franchises, brands, customers, channel partners, supply chain / service providers. Valuations tends to low and the ‘Trim & Fit’ companies tend to take a long term perspective in such acquisitions. They tend to proactively prospect for such opportunities.

“Given the number of people confined to their homes, there is an opportunity to make ‘Staycations’ more exciting!”

Gear-up for Take-off

The ‘Trim & Fit’ companies, as opposed to being psychologically ‘consumed’ by the crisis, tend gear up their entire organization for the take-off. They recognize that the ‘storm’ will pass in a relatively short time and that markets will return to a new normal. They optimize this downtime to invest in developing organizational capabilities and re-engineer their processes.

Invest in the psychological health – of those who make it happen

Despite the growing importance of ‘artificial intelligence’, it is people who finally make it happen, be it Staff, Customers, Shareholders, Suppliers etc. Due to the impact of such a crisis, it tends to have a severe impact on their psychological health and this in turn can negatively impact business performance – at a time when their resilience is even more critical.

Whilst dealing with the business emergencies, the ‘Trim & Fit’ companies focus and invest their energies on the human factor – across their entire business eco-system, not just confined to payroll staff. These smart companies also engage their staff (which by itself is a form of therapy) in seeking their views in surviving and turnaround the business. In many cases, this has led to voluntary pay cuts – as opposed to draconian cuts imposed from the top.

About MTI Consulting

MTI Consulting (www.mtiworldwide.com) is an internationally-networked, boutique management consultancy, enabling our clients to ‘Analyze > Strategize > Realize’ profitable business opportunities, Our practices include Strategy, Business Operations, Corporate Finance, Talent & Resourcing, Go-to-Market and Tech-Advisory.

Since our inception in 1997, MTI has worked on over 650 assignments in over 47 countries, covering a diverse range of clients, brands, industries and challenges. MTI is powered by a pool of internationally experienced Strategy Consultants and Analysts, augmented by a panel of Specialists – by Industry, Function & Geo-Domains and like-minded boutique consultancy relationships in over 30 countries.

Photo: Hilmy Cader (CEO), Darshan Singh (Middle East & Europe), Rajika Sangakkara (South Asia), Dr. Jason Cordier (Asia Pacific)